Categories such as advertising cost, administrative costs, labor costs and many others are used that help identify the type of cost. Understanding the nature and behavior of a particular cost element is much important for managers in exercising their decision making function. Once a cost lost or stolen refund is correctly categorized, effective cost control and cost management policies can be devised and implemented successfully. Their Vice president said that the players in the market have been conversing about the reduction of costs in this regard for as long as the technology has existed.

Average Fixed Costs versus Average Variable Costs

The food and lift ticket expenses are examples of variable costs, since they fluctuate based upon the number of participants and the number of days of activities. Two specialized types of fixed costs are committed fixed costs and discretionary fixed costs. These classifications are generally used for long-range planning purposes and are covered in upper-level managerial accounting courses, so they are only briefly described here.

- The down side to this approach is that once the new QA inspector is hired, if demand falls again, the company will be incurring fixed costs that are unnecessary.

- Table 2.2 illustrates the types of fixed costs for merchandising, service, and manufacturing organizations.

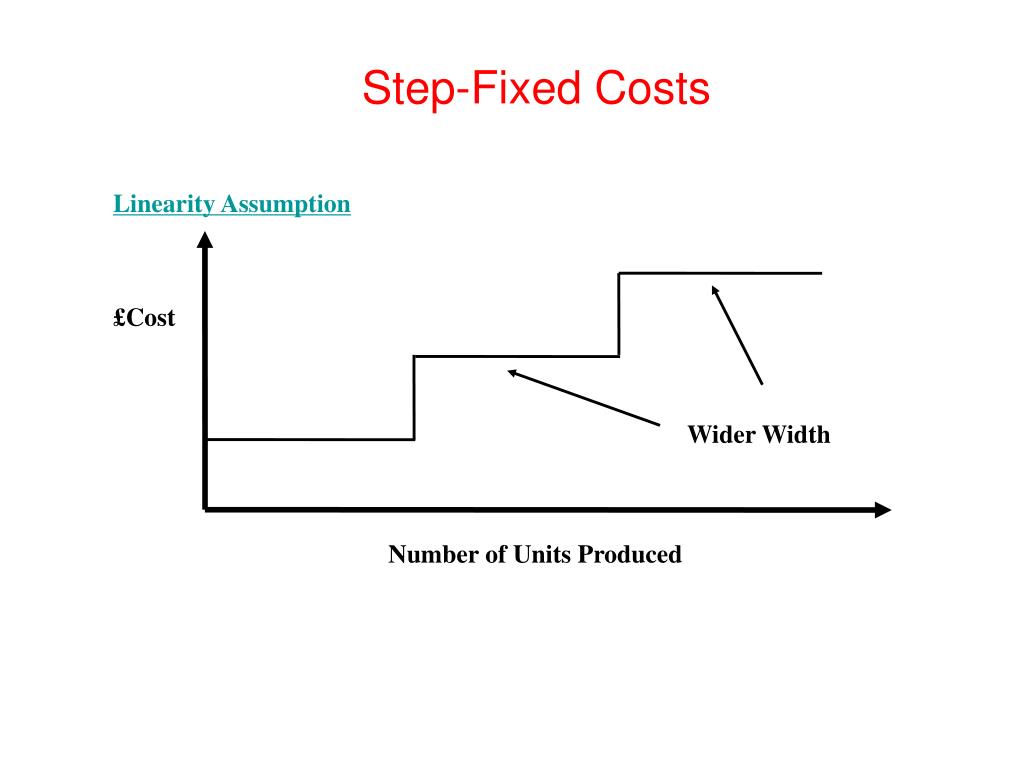

- These costs remain constant at a certain operational level, and beyond which these costs start to change (i.e., increase or decrease).

- Understanding different cost classifications and how certain costs can be used in different ways is critical to managerial accounting.

Avoidable Fixed Costs

However, the average fixed costs will be the total fixed costs divided by the number of participants. The average fixed cost could range from $720 (720/1) to $144 (720/5). Period costs are simply all of the expenses that are not product costs, such as all selling and administrative expenses. It is important to remember that period costs are treated as expenses in the period in which they occur. In other words, they follow the rules of accrual accounting practice by recognizing the cost (expense) in the period in which they occur regardless of when the cash changes hands. For example, Bert pays his business insurance in January of each year.

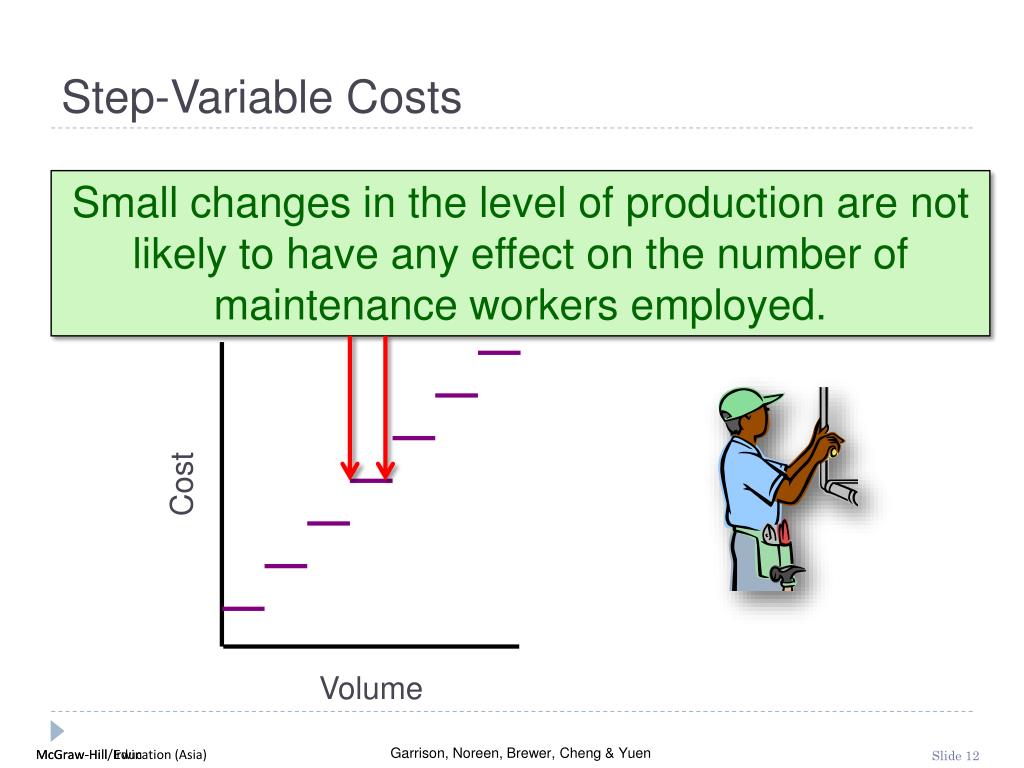

Step Costs

Tony’s information illustrates that, despite the unchanging fixed cost of rent, as the level of activity increases, the per-unit fixed cost falls. In other words, fixed costs remain fixed in total but can increase or decrease on a per-unit basis. Step cost refers to the cost that doesn’t change to the changes in activity levels but instead changes after a certain threshold is crossed. The cost follows the pattern of “steps.” As in, they remain stable for a specific level of output.

For the Essentials Plan of $30 per month, you can create up to three user accounts. The $30 cost remains constant whether you create just one user account or three. The moment you need a fourth account, your costs jump to $40 per month with the next level plan. Step costs are expenses that remain fixed for a range of workload, but then suddenly change after crossing a certain threshold level. Understanding step costing is extremely important when a company is about to reach a new and higher activity level, where it will be required to traverse a large step cost.

(1) Pay the quality inspector overtime in order to have the additional units inspected. The advantage to handling the increased cost in this way is that when demand falls, the cost can quickly be “stepped down” again. Because these types of step costs can be adjusted quickly and often, they are often still treated as variable costs for planning purposes. We have established that fixed costs do not change in total as the level of activity changes, but what about fixed costs on a per-unit basis?

Managerial accountants implement accounting reporting systems to minimize or prevent fraud and promote ethical decision-making. If the minimum or maximum expense range is exceeded, this can indicate that management is acting without authority or is pursuing unauthorized activities. Excessive costs may even be a red flag that possible fraud is occurring.

Then, at certain points, the step costs increase to a higher amount. For instance, wages often act as a stepped variable cost when employees are paid a flat salary and a commission or when the company pays overtime. Further, when additional machinery or equipment is placed into service, businesses will see their fixed costs stepped up.