He also doesn’t know for sure that he will be able to generate $20,000 of additional revenue from this piece of equipment year over year. The only thing he knows for sure is the price he has to pay for the machine today. As I mentioned earlier, this is an investment calculation that is used by all types of investors, not just traditional Wall Street investors. Company management compute the net present value of potential projects, expansions, or new equipment to evaluate what option will perform the best and decide what path the company should take in the future. A negative NPV indicates that the investment or project is expected to result in a net loss in value, making it an unattractive opportunity. In this case, decision-makers should consider alternative investments or projects with higher NPVs.

Evaluating the Role of Cost of Capital

For example, it’s better to see cash inflows sooner and cash outflows later, compared to the opposite. An investor chooses to buy shares of a technology company after analyzing its financial health, growth potential, and industry trends. This decision involves researching the company’s earnings reports, market position, and competitive advantages. The investor also considers their risk tolerance and investment horizon, deciding whether to invest for short-term gains or long-term growth, thus reflecting a strategy based on personal financial goals. Put more simply, NPV tells you what the present value of an investment or project (specifically the cash flows) is at a required rate of return (discount rate or hurdle rate). Additionally, a terminal value is calculated at the end of the forecast period.

To Ensure One Vote Per Person, Please Include the Following Info

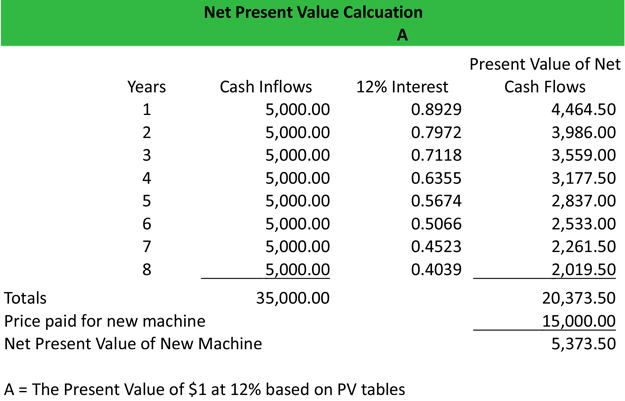

The present value (PV) of a stream of cash flows refers to the value of the future cash flows as of the current date. Obviously, the greater the positive number, the more return the company will how big companies won new tax breaks from the trump administration receive. Thus, a net present value calculator can not only be used to judge a good investment from a poor one, it can also be used to compare two good investments to see which one is better.

Cost of Capital as a Benchmark for Investment Decisions

Only such cash flows should be considered which are affected by the decision to invest in the project. Below is a short video explanation of how the formula works, including a detailed example with an illustration of how future cash flows become discounted back to the present. Net present value can help analyze and evaluate business projects or personal investments. You can easily see at a glance what you could stand to gain — or lose — from making a particular investment. But the NPV formula does have some limitations that are important to be aware of. Negative NPV, on the other hand, means you’re more likely to lose money on the investment.

Discount Rate

NPV is not the same thing as profit, although a positive NPV is indicative of profit, while negative NPV is related to a loss. You’ll need to know the present value calculation to complete the second step. In closing, the project in our example exercise is more likely to be accepted because of its positive net present value (NPV). If the net present value is positive, the likelihood of accepting the project is far greater. In practice, the XNPV Excel function is used to calculate the net present value (NPV).

Tools to Help Calculate NPV

- You’ll examine capital budgeting techniques, including net present value, internal rate of return, and payback period, to assess potential investments.

- The net cash flows may be even (i.e. equal cash flows in different periods) or uneven (i.e. different cash flows in different periods).

- This data can be used to compare different projects and their profitability to decide which project is the most lucrative to accept.

- As you can see, the net present value formula is calculated by subtracting the PV of the initial investment from the PV of the money that the investment will make in the future.

A lower or negative NPV suggests that the expected costs outweigh the earnings, signaling potential financial losses. Therefore, when evaluating investment opportunities, a higher NPV is a favorable indicator, aligning to maximize profitability and create long-term value. Meanwhile, today’s dollar can be invested in a safe asset like government bonds; investments riskier than Treasuries must offer a higher rate of return.

For example, receiving $1 million today is much better than the $1 million received five years from now. If the money is received today, it can be invested and earn interest, so it will be worth more than $1 million in five years’ time. The cost of capital helps companies evaluate potential projects and investments by providing a minimum acceptable return threshold. If the cost of investments is lesser than the cash inflows from the investments, then the project is quite good for the investor since he is getting more than what he is paying for.

The discount rate is an interest rate used to discount future cash flows for a financial instrument. As you can see, the net present value formula is calculated by subtracting the PV of the initial investment from the PV of the money that the investment will make in the future. NPV is an important tool in financial decision-making because it helps to determine whether a project or investment will generate a positive or negative return. If the NPV is positive, it indicates that the investment is expected to generate more cash flows than the initial investment and is therefore a good investment.

The discounted cash flows are inclusive of the cash inflows and cash outflows; hence, the usefulness of the metric in capital budgeting. The formula for calculating NPV involves taking the present value of future cash flows and subtracting the initial investment. The present value is calculated by discounting future cash flows using a discount rate that reflects the time value of money. • Calculating NPV helps determine the profitability of investments or projects by considering future cash flows and a discount rate. Most sophisticated investors and company management use a present value analysis or discounted cash flow metric of some kind when they are making investment decisions.